By Donald Shaw and David Moore, Sludge

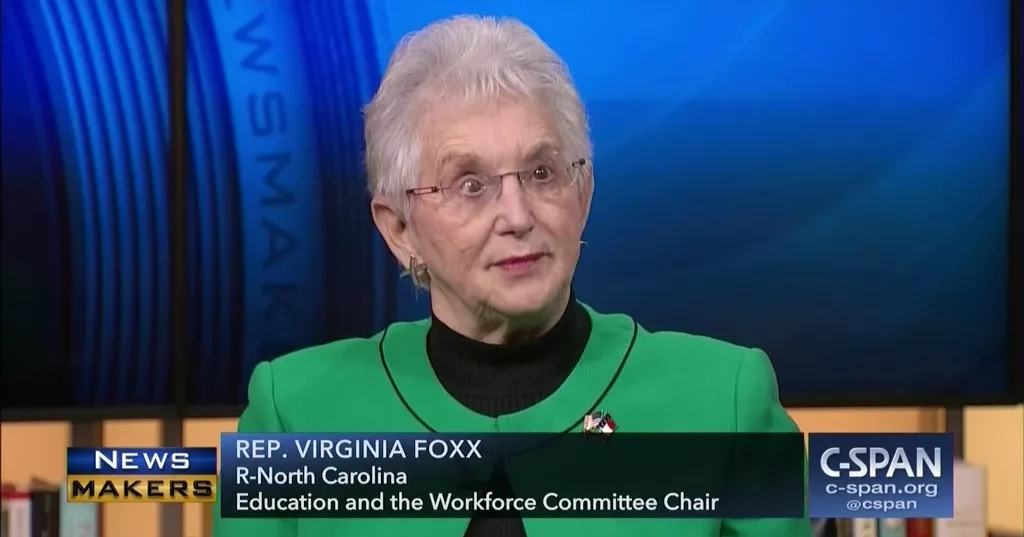

North Carolina Republican Rep. Virginia Foxx has been a prominent critic of the Biden administration’s overturning of a Trump rule that prohibits those overseeing pensions and other types of retirement funds from considering non-financial factors—such as environmental, social, or corporate governance considerations—in making investment decisions.

Foxx was just announced as the new chair of the Committee on Education & the Workforce, the committee with jurisdiction over the Department of Labor, and will likely hold oversight hearings on the rule. If she does, she will do so after making hundreds of trades of stocks in fossil fuel companies like ExxonMobil and Marathon Oil that could be hurt by the rule and likely while being invested in the companies.

Foxx will lead the committee after receiving a waiver that allowed her to avoid Republican term limit rules on chairs. Republicans renamed the committee from Education and Labor, as they did when taking control of the House in 1996 and again in 2010.

In spring 2021, the Department of Labor (DOL) initiated a rulemaking to implement two climate change-related executive orders from President Biden that directs its secretary to suspend a Nov. 2020 rule from the Trump government’s Employee Benefit Security Administration that requires retirement plan fiduciaries “to select investments and investment courses of action based solely on financial considerations relevant to the risk-adjusted economic value of a particular investment or investment course of action.” That rule was designed to restrict so-called ESG investing, in which investment managers limit their exposure to companies that contribute heavily to climate change and factor in other metrics like workplace diversity and corporate transparency.

In July 2021, while she was the ranking member of the House Committee on Education and Labor, Foxx criticized the rule making in a speech on the House floor. “The left’s woke agenda is putting the retirement savings of many Americans at risk,” she said, adding that “forcing ESG standards on retirement accounts is a clear violation of the Employee Retirement Income Security Act.” In October 2021, she issued a statement against the rule making along with her Republican colleague Rep. Rick Allen, and in December 2021 she and Allen submitted a regulatory comment to DOL Secretary Marty Walsh requesting that he rescind the rule.

This past November, while announcing the finalization of the rule, the Biden DOL said that the Trump restrictions prevent fiduciaries from considering ESG factors even when they would benefit plan participants financially. “The rule announced today will make workers’ retirement savings and pensions more resilient by removing needless barriers, and ending the chilling effect created by the prior administration on considering environmental, social and governance factors in investments,” said Assistant Secretary for Employee Benefits Security Lisa M. Gomez.

Foxx has pledged to hold many oversight hearings as chair, joking with reporters last August that if the Republicans control the House “we will probably be holding two oversight hearings a day, because we’re going to be so busy with oversight.” If she holds hearings on the DOL’s reversal of the anti-ESG rule, she would be doing so after making hundreds of trades in the stocks of fossil fuel companies that would likely benefit from having the Biden administration’s actions on the matter reversed.

Nearly half of the money Foxx and her spouse invested in corporate securities as of her most recent annual disclosure, covering 2021, appears to have been in shares of fossil fuel companies including ExxonMobil and Plains All American Pipeline, and she has since made dozens of stock trades in oil, gas, and pipeline companies. In 2022, Foxx’s stock trading included shares in Alliance Resource Partners, Marathon Oil, Duke Energy, Green Plains Partners, Hess Corporation, Kinder Morgan, Magellan Midstream, Antero Midstream, Phillips 66, and other fossil fuel companies. In August, when she joked of holding a stream of oversight hearings if Republicans took control of the House, Foxx purchased tens of thousands of dollars worth of stock in the liquid natural gas shipping company Flex LNG.

The fossil fuel industry has viewed ESG pressure as a major challenge over the past several years, and many companies in the industry have invested heavily to create the impression that they are environmentally responsible. But while the companies themselves don’t typically argue against ESG initiatives, their trade associations have been doing it for them, including by lobbying in opposition to government actions such as that undertaken by the Biden DOL.

Many of the pipeline companies whose stocks were a focus of Foxx’s activity belong to fossil fuel industry trade associations that oppose the Biden DOL’s rulemaking.

Over the past three years, Foxx made more than a dozen trades in the stock of Houston-based Enterprise Products Partners, one of the largest energy pipeline companies in North America by market cap. Enterprise is a member of the U.S. Oil and Gas Association, which in December 2021 submitted a public comment to the DOL, co-authored by the Western Energy Alliance, that expressed concerns about its plans to reverse the Trump anti-ESG rule. “We have observed how ESG advocacy has negatively affected the industry’s access to capital over the last few years as proponents consider only a narrow view of ESG and ignore all the benefits we provide,” the groups wrote. Foxx’s investments in Enterprise Products Partners stock are worth as much as $230,000 as of her most recent periodic transaction report. Several more companies Foxx trades stock in are members of the U.S. Oil and Gas Association, including Kinder Morgan, Marathon Oil, Phillips 66, and ExxonMobil.

The corporate-backed nonprofit American Legislative Exchange Council (ALEC) also filed a comment opposing the DOL rule. Since late 2021, ALEC has promoted a model bill, one that has been signed into law in several states, that seeks to penalize companies that take ESG factors into account in their commercial relationships with other companies, by barring them from receiving state contracts. In the previous Congress, House Republican lawmakers proposed multiple bills that would amend the Employment Retirement Income Security Act so that only pecuniary factors could be considered by those overseeing retirement funds.

Several of the companies Foxx has traded stock in are members of the American Fuel & Petrochemical Manufacturers (AFPM), which has opposed a separate ESG-related rule that is being promulgated by the Securities and Exchange Commission. That rule would require publicly traded companies to disclose information about their climate change-related plans and how climate change could impact their businesses, a requirement that AFPM says could “[add] burdensome costs to corporate reporting.”

Foxx is one of the House’s most active stock traders, a pattern that accelerated in 2022, with a pronounced increase in purchases of the stocks of oil and gas pipeline companies. Overall, Foxx stepped up her stock transactions with more than 275 trades in 2022, compared with around five dozen in each of 2021 and 2020, according to House disclosures. The month that the Democrats’ budget package the Build Back Better Act was being marked up in House committees, September 2021, potentially setting up the approval of a major clean energy program, Foxx was picking up shares in oil giants BP and ExxonMobil.