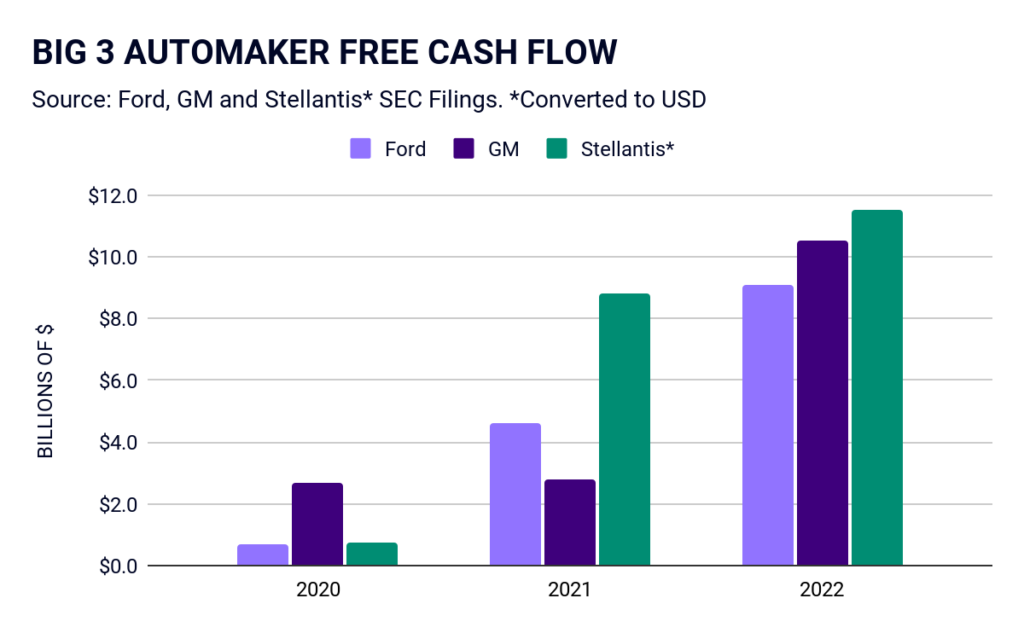

In 2022, General Motors, Ford, and Stellantis (formally Chrysler) combined to generate around $31 billion of free cash flow, an increase of 91% from the year before. Last week the companies continued their financial success by delivering their best results in modern memory.

The results set up a potential confrontation with the United Auto Workers (UAW), who are looking to use the upcoming contract negotiations to regain pay and benefits given up when the industry was on the brink of bankruptcy over a decade ago. “I’m hoping to see us get back what we had back from 2007,” Stephanie Carpenter, a 26-year member of the UAW Local 22 told the Detroit News. “COLA is huge…it’s time for them to give that back.”

During the financial crisis, the UAW agreed to a number of concessions to help the struggling companies, which are still in place today. “Autoworkers and our communities,” UAW President Shawn Fain said in a statement after GM’s record earnings, “have yet to be made whole for the sacrifices we’ve made since the Great Recession.” These sacrifices included an end to annual COLA raises, overall lower pay and pensions, and a tiered worker system.

The auto industry looks much different today than during the crisis, which ultimately saw General Motors and Chrysler declare bankruptcy.

The biggest difference is: companies are now making money manufacturing cars—a lot of it.

In the last reporting period, Stellantis recorded $12 billion in profits–good enough for the most profitable six months in the firm’s short history. General Motors shattered revenue records and expects to make around $9 billion in profit this year–$1 billion more than management expected. Not to be outdone, Ford nearly tripled its profit compared to the same time last year.

In reviewing General Motor’s earnings, the Wall Street Journal said it could actually be a downside with the upcoming negotiation. “Extremely healthy profit”, risked “undercutting the point” that the company was making significant investments in electric vehicles.

The free cash flow at Ford, General Motors and Stellantis back up that idea.

A basic version of free cash flow is operating profit (e.g., pre-tax money the company makes selling automotives) less big capital investments (e.g., new EV factories)

Right now, even after taking account for investments in the future, all three companies are generating at least $9 billion in free cash flow a year. One management team thinks it can go higher. Stellantis told investors that it would double that number by 2030.

Investors love free cash flow because the higher it is, the more money companies can send back to shareholders through dividends and stock buybacks. Executives care about it because they have a financial interest in caring. Executive compensation at General Motors, Ford, and Stellantis is directly tied to how much free cash flow the companies generate.

Unions should love it because that money can be reinvested into workers through higher wages and benefits. “Strong financial results are great for companies,” the Wall Street Journal concluded, “except when they are negotiating with unions.”

Right now the big three are showing strong financial results by nearly any metric.