If more consumers buy more of our products, consumers will be better off.

That’s one of the arguments that grocery giant Kroger is making to ensure regulators approve its proposed $26 billion merger with Albertsons. So far, the “what’s good for me is good for society” line doesn’t seem to have many fans in the Senate.

This week the company faced bipartisan scrutiny during the Senate Judiciary Committee hearing on the transaction. “If Kroger wasn’t passing on savings to consumers when it was competing with Albertsons,” Sen. Mike Lee (R-UT) asked, “…why would we think it would pass on savings after it eliminates that competition?” Committee chair Sen. Amy Klobuchar (D-MN) was more concise. “With less competition, won’t Kroger feel less pressure to keep prices low?”

To assure regulators, the company preemptively made a variety of different price and labor-related promises, including commitments to invest $500 million in price discounts over the next four years. That breaks out to be $125 million a year—an almost immaterial amount for a company that would generate annual revenues of $210 billion. If Kroger had made a similar investment last year, its gross profit margins, which measure profit after accounting for the cost of goods, would have narrowed from 22.72% to 22.66%.

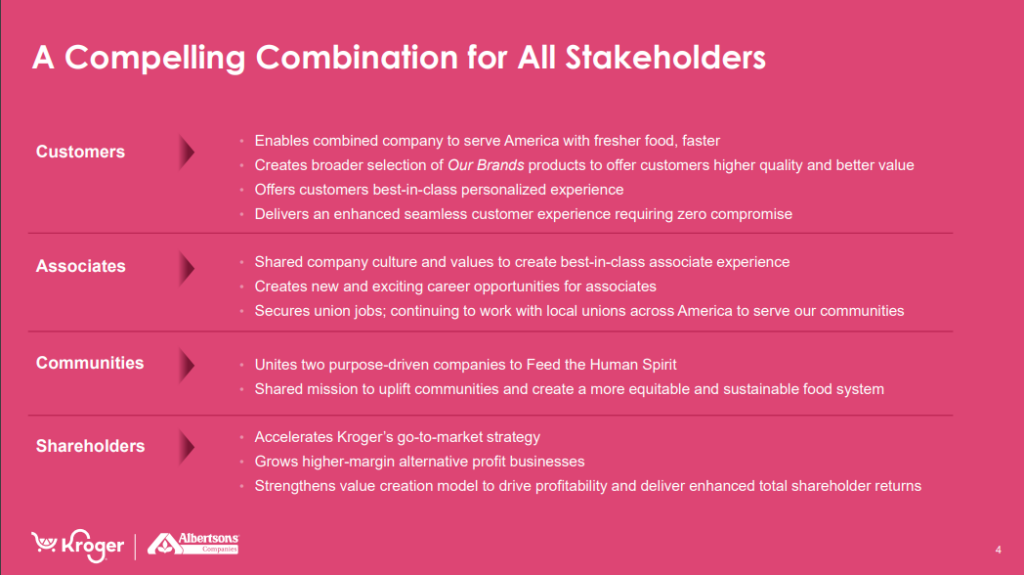

In the hearing, Kroger management defended the merits of the merger by highlighting previous messaging shared with investors.

They claim that the merger:

- Enables combined company to serve America with fresher food, faster.

- Creates broader selection of Our Brands products to offer customers higher quality and better value.

- Offers customers best-in-class personalized experience.

- Delivers an enhanced seamless customer experience requiring zero compromise.

But it would actually be the newly-merged grocery giant—not customers—who’d benefit from these changes.

Let’s break down what each talking point means.

“Enable combined company to serve America with fresher food, faster.”

Translation: The combined company would better distribute fresh food from warehouses to grocery shelves.

- In grocery, when there’s competition, fresh food is the biggest driver for where people shop. Past competition, not the merger, already pressured Kroger and Albertsons to build networks that can deliver it quickly and profitably.

- “More fulfillment centers or fuel locations is not a merger-specific efficiency,” Consumer Reports’ Sumit Sharma told the Senate in his written testimony on the merger. The companies already invest in the infrastructure.

- Kroger currently supplies 2,700 stores from 45 distribution centers. Albertsons uses roughly half that amount to supply 2,000 stores. There could be cost savings from integrating the networks, but absent market competition, there’s no evidence to suggest that any savings will be passed on to customers.

“Creates broader selection of Our Brands products to offer customers higher quality and better value.”

Translation: If more consumers buy more of our products, consumers will be better off.

- Are Kroger’s private label products higher quality and better value for consumers? That’s debatable, but it’s not debatable whether Kroger will receive significant benefits from expanding its private label offerings.

- Store brand products are typically a boon for retailers because they do not require marketing. This allows retailers to sell items cheaper than branded competitors–while maintaining higher profit margins.

- In its most recent earnings call, Kroger executives credited private label sales growth with increasing operating profits by 37% this quarter.

- The merger would create one of the largest consumer goods companies in America. In 2021, Kroger and Albertsons sold 34,000 different private label items and generated $43 billion in revenue, $3 billion more than industry icon Coca-Cola’s entire worldwide sales.

“Offers customers best-in-class personalized experience.”

Translation: The new Kroger could better price discriminate against shoppers who aren’t part of the company’s loyalty club..

- Personalized offers are price discrimination. Instead of offering lower prices to all customers, Kroger uses personalized pricing–where coupons and discounts are only available to loyalty members based on past purchases. Think of it as the grocery version of Ticketmaster’s hated dynamic pricing.

- In 2022, Kroger estimates it will spend $200m on personalized offers–$75 million more than management committed to lower prices for all consumers if the merger passes.

- Management is not spending the money out of the goodness of their heart. Personalized price discounts create a significant incentive for consumers to join the loyalty program. The industry refers to it as a “flywheel” because it keeps consumer dollars within the system.

- If approved, Kroger will grow its loyalty program from 60 million members to 85 million. “No evidence,” Sharma said, “is presented to suggest that the ability to analyze data on an additional 25 million households would materially improve capabilities to personalize experiences.”

“Delivers an enhanced seamless customer experience requiring zero compromise.”

Translation: People can shop online, in-store, or a combination of both.

- Major retailers are looking to become omnichannel–allowing customers to shop online or in-store. Similar to the previous benefits, Kroger’s existing capabilities offer 98% of customers the ability to shop online for pick-up or delivery.

- As Sharma pointed out in his testimony, these investments are independent of the merger. In 2021, pre-merger, Kroger invested significant money building warehouses optimized for grocery delivery.

- These investments aren’t simply customer orientated, but a way for Kroger to push higher margin products. 60% of recent online purchases were influenced by Kroger’s algorithms.

- Zero compromise presumably means that there will be no compromises?

Momentum against the merger is growing–and for a good reason. Kroger’s customer benefits are thinly veiled arguments for its profitability. The most striking examples are its argument that customers would significantly benefit from being able to buy more of its private-label products and enable the company to practice better price discrimination.

“The loss of competition is certain, Mr. Sharma summarized. “These expected efficiencies are uncertain.” The same applies to customer benefits.