By Donald Shaw and David Moore, Sludge

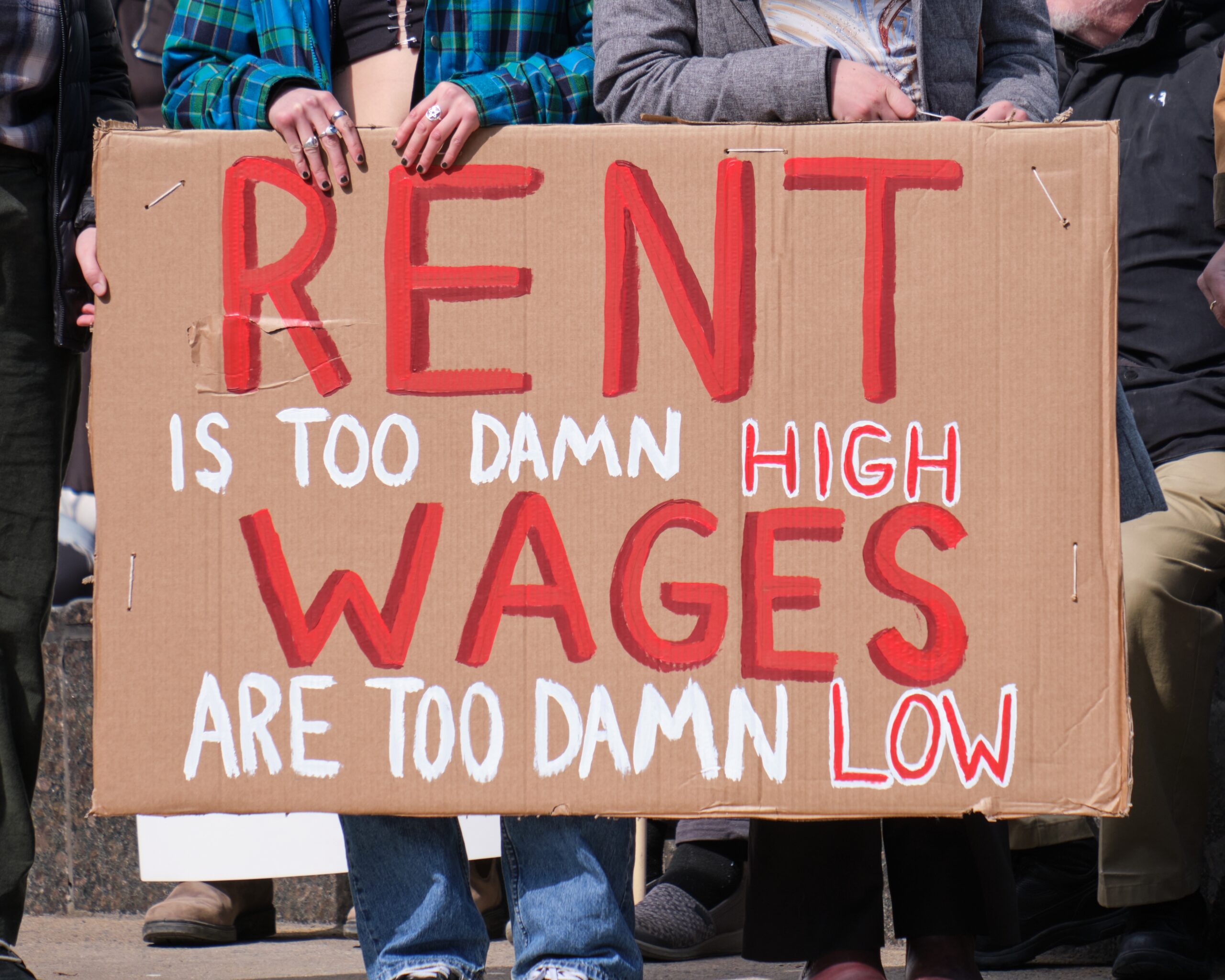

The coronavirus pandemic and widespread job loss put the squeeze on renters, many of whom were already facing the burden of high housing costs. Almost half of renters in 2020 met the federal definition of “cost burdened,” meaning they spent at least 30% of their income on housing, according to data from the U.S. Census Bureau. For nearly a quarter of renters, at least half of their income went to rent checks.

Shelter cost inflation began rising in early 2021 and has increased roughly 5% since then, putting major economic pressure on many Americans along with rapidly-inflating prices for food, gasoline, and consumer goods. Rent inflation remained rapid in the latest Consumer Price Index data, increasing at more than double the typical rate per year, and shelter costs have recently been pegged as the single largest factor driving core inflation up. Overall in housing costs, it’s a return to the record highs of the 1980s.

There are many factors affecting housing prices—supply chain issues, remote workers fleeing cities during the COVID lockdowns, and years of very low mortgage interest rates that helped to fuel a buying frenzy. But another factor making housing more expensive and predatory for many is a massive real estate industry trade group that spends millions of dollars each year to lobby governments in the U.S. While the National Association of Realtors (NAR) and its state affiliates are mostly known for their advocacy for homeowners’ tax advantages, it also sides with landlords and real estate investors on a myriad of policy debates that make housing more expensive and less stable for renters.

Opposition to Rent Control Laws

NAR is strongly against rent control laws, writing on its issue tracking website that “The social responsibility of providing affordable housing should not be disproportionately borne by private property owners” and that “Rent control and rent stabilization put unreasonable costs and burdens upon property owners without compensation.”

NAR says on its website that earlier this year it helped to draft and pass a law in Ohio, Substitute House Bill 430, that includes a provision preempting local governments in Ohio from capping rents. The bill appears to be NAR’s response to an effort by the “Columbus Coalition on Rent Control” to put a citywide rent control measure on the ballot. It was signed by Ohio Gov. Mike DeWine in June and took effect on September 23. The Ohio Association of Realtors, a NAR affiliate, has donated at least $43,000 to DeWine, according to OpenSecrets.

Now, with rents surging across the country, many municipalities will be considering rent control ballot measures in the November elections, and NAR and its state affiliates are using their resources to try and prevent the new laws from passing.

In Pasadena, California, where there are currently no local rent control laws to protect tenants, voters will be deciding on Measure H, which would limit how much landlords can increase rents and spell out eviction protections for tenants. The campaign committee opposing the measure’s largest donor is NAR, which gave it $100,000 in late September, according to a campaign finance filing that covers donations through October 22. The PAC of NAR’s California affiliate, the California Association of Realtors, has chipped in another $95,000 to oppose the measure.

In Orange County, Florida, the Florida Association of Realtors, a NAR affiliate, filed a motion for a temporary injunction over the summer along with the Florida Apartment Association to block a rent stabilization ordinance from appearing on the November ballot. In September, the groups’ motion was denied by a judge and the measure is on the ballot, though the realtors’ association continued its legal fight and last week an appeals court judge ruled that the measure should not have been put on the ballot.

NAR and its Florida affiliate have formed a PAC called the Realtors Issues Mobilization Committee that has begun sending mailers against the measure that feature images of handcuffs and warn that landlords who violate the ordinance could be jailed. The group received more than $1.3 million from NAR in October and nearly as much from Florida REALTORS since April of this year, according to records from the Florida Department of State.

Rents in Orlando, part of Orange County, increased by 27% from the second quarter of 2021 through the second quarter of 2022, the second-highest increase in any city in the country over that period.

Opposition to a Federal ‘Renter Bill of Rights’

At the end of May, the White House convened what it called a Housing Provider Listening Session to discuss with industry stakeholders how a coordinated national policy could tackle the housing affordability crisis. During his campaign, President Biden called for a new Homeowner and Renter Bill of Rights, modeled after a set of California laws, that would expand renters’ protections from abusive landlords and lenders. Other measures Biden proposed as a candidate would facilitate legal assistance for renters facing evictions, enhance accountability measures for financial institutions over discriminatory housing practices, and reverse the Trump administration’s rolling back of an Obama rule requiring communities that receive some federal housing funds to identify and address policies that have discriminatory impacts.

The day after the listening session, NAR and other real estate and mortgage industry groups were ready with a letter that they sent to President Biden and administration officials opposing the idea of a federal renters’ bill of rights. The letter argues that such measures at the federal level would “Create unnecessary duplication of renter protections that are already required by and disclosed in landlord-tenant, eviction and fair housing laws.” Instead, to address affordability challenges they suggested increasing the supply of affordable housing units and incentivizing voluntary participation in federal housing programs.

Opposition to COVID Eviction Moratoriums

In 2021, NAR opposed the extension of the federal eviction moratorium that the Biden administration issued in August that was meant to last through October of that year. In a case brought by the Georgia and Alabama Associations of Realtors with NAR’s help, the Supreme Court on August 26 ruled to end the moratorium, arguing that the Centers for Disease Control and Prevention did not have authority and would have to get action from Congress.

NAR celebrated the victory: “This decision is the correct one, from both a legal standpoint and a matter of fairness. It brings to an end an unlawful policy that places financial hardship solely on the shoulders of mom-and-pop housing providers, who provide nearly half of all rental housing in America, and it restores property rights in America.”

Earlier in 2021, NAR wrote to the Biden administration to argue against the eviction moratorium that was currently in place to protect people whose livelihoods had been interrupted by the COVID lockdowns. NAR argued in the letter that the moratorium was hurting the rental housing sector by reducing rental income, and that the policy was not aligned with COVID rental assistance programs that were emerging in cities and states.

Support for Repealing 30-Day Eviction Rule

NAR is supporting a bill that was introduced in the House of Representatives in September by Georgia Republican Rep. Barry Loudermilk and other House Republicans that would overturn a CARES Act provision that requires all landlords nationally to provide 30-day notice before they begin eviction proceedings. The 30-day federal notice requirement is longer than what is required by many states, which Loudermilk says on his website is just 8 days on average. The bill’s backers say the 30-day national requirement was supposed to be temporary, but that it was made permanent in the CARES Act due to a drafting error.

“This technical error in the language of the CARES Act takes away the power of states, localities, and the judicial system to control eviction policies and procedures, and adds confusing ambiguity to the process,” NAR wrote in a letter thanking Loudermilk and the other Republican co-sponsors for proposing the bill.

The real estate industry has been one of Loudermilk’s top donors over the course of his career, providing him with more than $250,000 in campaign funding, according to OpenSecrets. Of that sum, NAR’s PAC accounts for $43,000.

Support for Suspending the FHA’s Anti-Flipping Rule

In the early 2000’s, the Bush administration established anti-flipping rules in order to prevent rapid home purchases and sales from artificially increasing the prices of homes beyond their true market values. The rule requires houses bought with Federal Housing Administration (FHA) financing to have a title that has “seasoned” for at least 90 days. The government explained at the time of the rule that the purpose was to counter predatory lending that could happen if unsuspecting housing consumers were to finance properties whose prices had been artificially inflated by flipping.

In December 2021, NAR asked the FHA to suspend the rule, writing in a letter that doing so would help so-called ibuyers (companies that use algorithms to make offers and buy homes, also known as “instant buyers”) buy, remodel and sell homes, therefore making more homes available on the market.

Pushing Back Against ‘Disparate Impact’ Rules

Since 1968, the Department of Housing and Urban Development (HUD) had interpreted the Fair Housing Act to prohibit housing practices that have a discriminatory effect, even those without overt intent—known as a “disparate impact,” says the nonprofit National Low Income Housing Coalition, which works for racially equitable public policy.

In 2015, the U.S. Supreme Court addressed discriminatory housing outcomes in a 5-4 ruling in the case Texas Department of Housing and Community Affairs v The Inclusive Communities Project. Retired Justice Anthony Kennedy, writing for the majority, recognized the validity of disparate impact claims, but warned that courts should develop further limitations on their use. Toward the end of the Trump administration, HUD adopted a rule that gutted fair housing protections, a move that the Biden administration sought to reverse in the months after signing executive orders in January 2021.

On its website, the group says, “NAR believes that eliminating disparate-impact discrimination, as defined by the Supreme Court in its 2015 Inclusive Communities decision, helps protect both the legitimate business interests of real estate professionals and the fair housing rights of consumers.”

On housing vouchers, a policy program designed to address racial segregation that advocates say has been underfunded, NAR’s website is unenthusiastic. “NAR opposes proposals to mandate housing voucher acceptance for landlords,” the group says. In a summary document posted on its legislative tracker, NAR wrote, “The selection of tenants and the terms of the contractual relationship are the function of the property owner or manager, not the government. Allowing certain tenants to have different (government-mandated) provisions included in their leases is unfair to all residents of the property.”

A Lobbying Giant

Legislation touching on the realtors’ group’s issues faces a gauntlet of lobbyists on Capitol Hill—for the past several years, NAR has been one of the top two highest-spending groups on federal lobbying. In the first three quarters of 2022, NAR spent $56.2 million on lobbying, according to records from the Senate. It was the second highest-spending lobbying group over that period, behind the behemoth U.S. Chamber of Commerce. Through the first three quarters of this year, NAR’s federal lobbying has surpassed the $44 million it spent in 2021.

Many members of NAR’s lobbying corps have come in through the revolving door. Brendan Dunn, a partner at Akin Gump who lobbied this year for NAR on housing supply, bills himself as a former chief adviser to Sen. Mitch McConnell and the Senate Republican leadership on tax matters. Warren Tryon, a partner at bipartisan firm Capitol Counsel who lobbied for NAR on housing issues, mentions his stint as GOP deputy staff director for the House Financial Services Committee.

As it lobbies on housing and tax issues, NAR also showers campaign contributions on federal lawmakers: the realtors’ group’s PAC has given more money to candidates than any other PAC in the 2022 election cycle, according to OpenSecrets, with more than $2.6 million donated. In a change from the past few years, its overall PAC giving this cycle leans slightly toward Democrats over Republicans.

The lobbying group is deep-pocketed—in its most recent IRS disclosure for fiscal year 2020, NAR reported a total revenue of more than $301 million.

NAR shows a willingness to jump in to influence elections on both sides of the aisle, placing it among the top 20 groups in outside spending in the 2022 cycle, according to a tally from OpenSecrets. In addition to the $8.3 million it has spent on independent expenditures so far this cycle, supporting both Democratic and Republican congressional candidates, it donated $600,000 to the Kevin McCarthy-aligned super PAC Congressional Leadership Fund and $300,000 to a North Carolina PAC that supported Republican state Sen. Chuck Edwards over Rep. Madison Cawthorn in the primary. On the Democratic side, NAR sent $300,000 to the super PAC Our Hudson in New York, backing DCCC Chair Rep. Sean Patrick Maloney as he faced a challenge from progressive state Sen. Alessandra Biaggi.

Realtors also flex their muscle by funneling campaign contributions through the conduit service Votesane, which has a board composed of individuals with ties to the mortgage and real estate industries. In the 2022 cycle, nearly every Votesane donor is a realtor or real estate executive, according to FEC data. The top recipients of funds donated through Votesane in the 2022 cycle are the National Republican Congressional Committee ($277,500), Sen. Tim Scott ($263,209), Sen. Marco Rubio ($199,786), Sen. John Thune ($177,500), and the National Republican Senatorial Committee ($170,500). They’re followed by Sen. Joe Manchin ($160,765), an Appropriations Committee member; Rep. Van Taylor ($153,575), a Financial Services Committee member; Sen. Catherine Cortez Masto ($143,000); Rep. Peter Stauber ($133,025); and Sen. Jerry Moran ($133,000), who sits on the Banking, Housing and Urban Affairs Committee.