U.S. voters overwhelmingly support raising taxes on the wealthy and large corporations, according to a new poll by Data for Progress and More Perfect Union. Support for a tax on extreme wealth, such as the one proposed by Sen. Elizabeth Warren (D-Mass.), is backed by 63 percent of Americans, and 61 percent of U.S. voters support increasing the corporate tax rate. However, the most surprising finding in the new poll is that Republican voters support a wealth tax by a 4-point margin, 45-41 percent. “Billionaire wealth is more than 50% higher now than it was before the pandemic and our tax system still favors the ultra-rich, so it’s no wonder a wealth tax is increasingly popular across party lines.,” Sen. Warren said in a statement. “Just a two-cent tax on fortunes above $50 million — and a few cents more for the billionaires — would generate trillions. This is one way we can make this government work for everyone – not just the rich and powerful.”

Voters support implementing a wealth tax

The poll asked voters whether they supported or opposed a wealth tax of two percent on individuals worth between $50 million and $1 billion dollars in wealth, and a three percent tax on net worth over $1 billion dollars — a proposal which would raise approximately $3 trillion dollars over ten years. It found that likely voters strongly support a wealth tax, by a 38-point-margin. Further, voters across the partisan spectrum are in favor of it: Democrats support a wealth tax by a 73-point margin, Independents by a 33-point margin, and Republicans by a four-point margin.

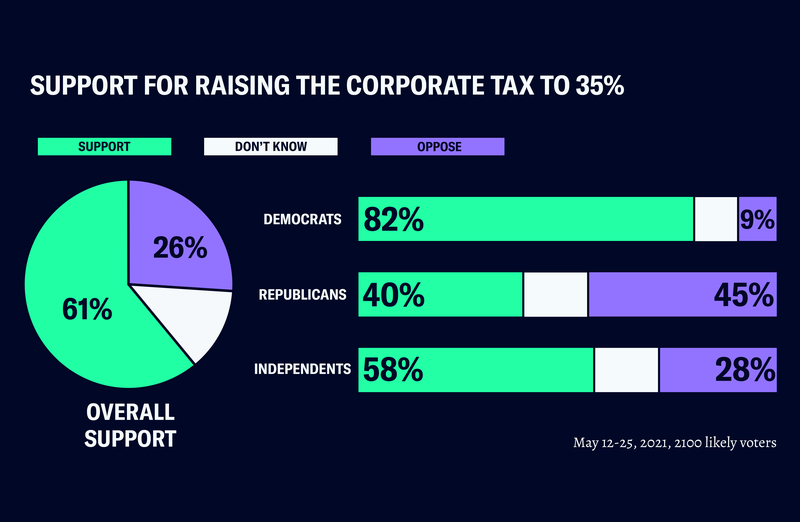

Voters support restoring the corporate tax rate to 35 percent

The Corporate Tax rate was 35 percent until Republicans dropped it to 21 percent in 2017 during the Trump Administration. The poll asked likely voters if they supported or opposed restoring the Corporate Tax rate to its previous 35 percent while also reducing loopholes, tax breaks, and accounting tricks that multinational companies use to avoid taxation. Likely voters strongly support this proposal. Among all likely voters, restoring the previous Corporate Tax rate is supported by a 35-point-margin, including Democratic voters who support it by a 73-point-margin and Independent voters by a 30-point-margin. Republican voters oppose raising the Corporate Tax rate by just a five-point-margin.