Major U.S. airlines have signaled to investors that they intend to maintain profit margins by cutting America’s already depleted regional air network, which connects smaller communities to larger cities.

“We’ve planned for this,” United CEO Andrew Nocella said on a recent earnings call. The preliminary plan involves fewer flights to regional airports on bigger planes. Some cities may see service cut off completely. “We’ve already shut down 17 or 18 (cities) because of lack of RJs (regional jets) that we can’t fly to,” he concluded. “It’s an unfortunate outcome of where we are, but that is what the outlook looks like at this point.”

After a COVID era regional pilot shortage forced American Airlines to cut thousands of flights and lose out on millions of revenues, management finally agreed to raise wages to attract more workers. “The days of being able to go out and attract a pilot for wages that are $40,000 a year are gone,” CEO Robert Isom said during American’s Q2 earnings call. It’s not that airline executives didn’t try. When the pilot shortage began impacting corporate finances, industry executives floated lowering pilot education and training standards to solve the shortage rather than increasing pay.

Under the new American Airlines contract, which was announced in June, regional pilots at American-owned operators can expect a significant pay increase through 2024. Some pilots will see an increase of almost 70% from the previous contract. “We’re still not talking about exorbitant salaries,” Isom told analysts after some questioned the financial viability of higher regional pilot wages.

But higher pilot pay won’t prevent millions of Americans from being cut off from access to flights. During the pandemic, carriers have suspended service for a number of cities and stopped service altogether for others. United announced it would stop 17 different regional flights. In September, American Airlines will cut service for four cities, including Toledo, Ohio. The Toledo metro area is home to nearly 500,000 people, but it will lack daily flight service. In 2021, Delta cut 7 regional routes and 3 cities altogether. One of those cities is Lincoln, Nebraska. The state’s capital and home of its flagship university.

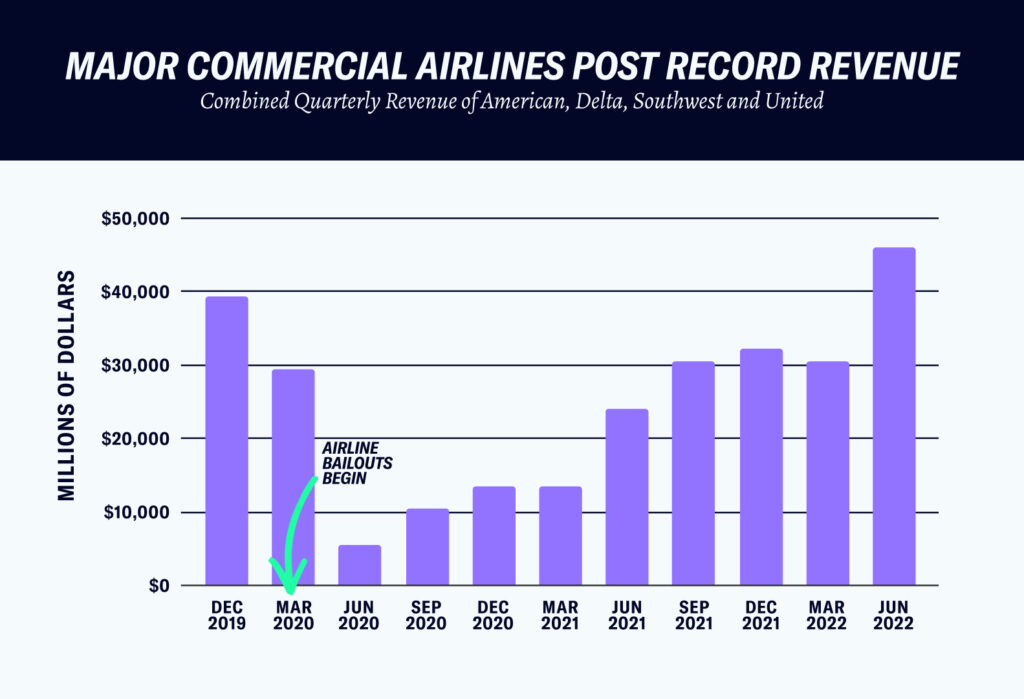

Despite record disruptions, airlines have posted historic revenue numbers after being rescued by American taxpayers at the start of the pandemic

- The pandemic reduced passenger volume by 95% and sent global airline industry revenue spiraling down by $314 billion. Given the crisis, American taxpayers bailed out airline companies with about $54 billion in grants, loans, and other funding.

- The bailout included provisions to protect American jobs, but airline management used furloughs and early retirements to reduce their workforce by 56,000 people. Labor shortages have helped fuel this summer’s flight cancelation crisis.

- After struggling with profitability throughout the pandemic, the companies delivered record sales and profits in Q2. American and United booked the highest revenue in their histories. Delta recorded the best margin since the pandemic started. Southwest reported “record” revenue and profit for the quarter, despite capacity being down 7%.

- According to management, the only thing holding back more corporate profits is a lack of pilots. “Pilot recruiting, training, and retention,” United’s Nocella said, “are real constraints for the industry for years to come.”

America’s air system is built around corporate profitability rather than service

- Prior to 1978 the Civil Aeronautics Board regulated air routes and fares to ensure equal access across the country. The Carter Administration deregulated the industry, giving “air carriers almost total freedom to determine which markets to serve domestically and what fares to charge for that service.”

- This deregulation occurred parallel to America’s adoption of a lax antitrust enforcement policy. Prior to 1978, there were 14 mergers in the airline industry. From 1978-2022, there have been 42 mergers.

- The four remaining major airlines (American, Delta, Southwest, and United) were once 27 independent airlines.

- Despite free reign over fares and routes, all four major American airlines have underperformed the S&P 500 in the past five years. $100 invested in an S&P 500 index fund on 12/31/2016 would now be worth over $200. Comparatively, an investment in any of the four airlines would have done significantly worse–with American Airlines losing 60% of its value during that time.

A profit-driven route system has destroyed regional air travel in America

- To maximize profits, American, Delta, and United have abandoned most regional direct flights. Instead, the companies operate under a “hub and spoke” model where small regional jets carry passengers to centralized hubs.

- Prior to the pandemic, consolidation primarily impacted mid-sized Rust Belt cities. Compared to 1999, in 2019 Pittsburgh had 159 less flights a day; Milwaukee 23% less. St. Louis, which was once the main hub of Trans World Airline (acquired by American Airlines in 2001), saw flights decline from 632 a day at the turn of the century to less than 250 in 2019. A 2012 article by Phillip Longman and Lina Kahn outlined how a decline in air service economically punished the region.

- The federal government currently spends $340 million each year to ensure air service for 111 small communities through the Essential Air Service program.