By Donald Shaw and David Moore, Sludge

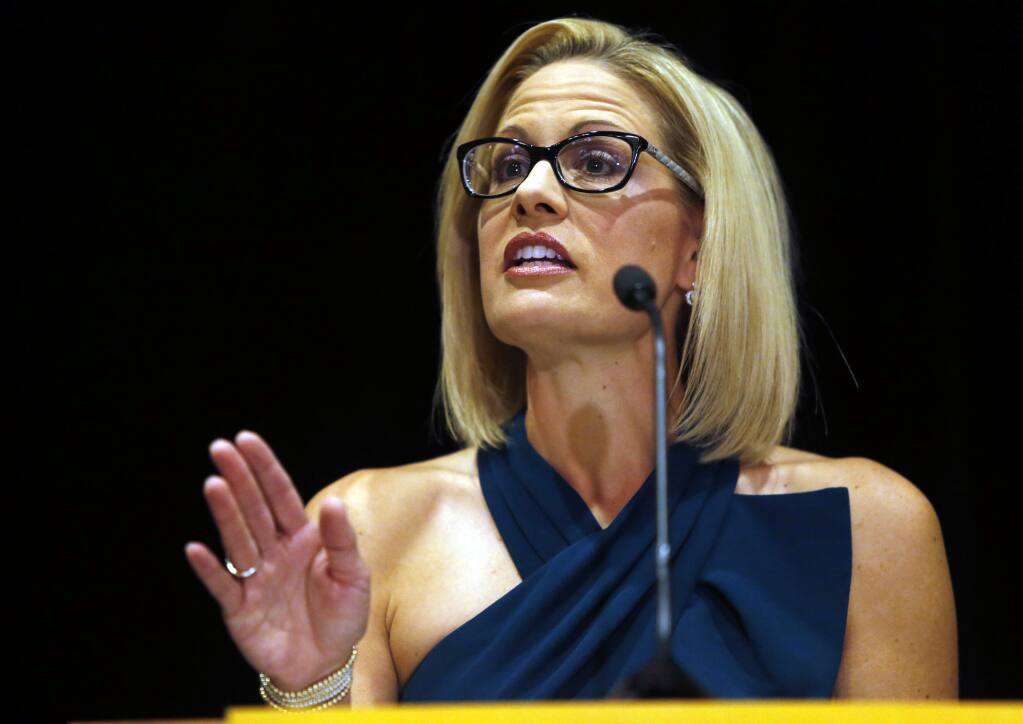

Arizona Sen. Kyrsten Sinema is leaving the Democratic Party to register as an independent, again complicating the ambitions of a party that had seemingly grown its majority in the November elections.

In an op-ed published in the Arizona Republic on Friday, the first-term senator decried the “rigid partisanship” of national politics and declared that her Senate seat “does not belong to Democratic or Republican bosses in Washington.” Sinema pledged in an interview that the registration change would have little practical impact: “Nothing will change about my values or my behavior,” she said.

Should she continue to be guided by those same values and behavior, a review of her record suggests that such consistency will most benefit Wall Street and major corporations. Since Democrats took control of the Senate with the slimmest of majorities in 2021, Sinema has consistently worked to protect the nation’s wealthiest individuals and most powerful corporate institutions from modest tax increases amid soaring inequality.

In the fall of 2021, Sinema single-handedly scuttled a deal that would have partially reduced the Republicans’ Trump-era tax cuts for corporations and wealthiest 1% of individual earners. That helped to ultimately crash the party’s ambitious Build Back Better package of new social infrastructure spending.

This summer, she weakened a 15% minimum tax rate on corporations that often pay nothing in federal taxes, and also worked to protect the special status afforded to Americans who make their money through high-end Wall Street investments.

On August 4, Sinema announced that she struck a deal with Majority Leader Chuck Schumer to remove language from the Inflation Reduction Act (IRA) that would have narrowed a tax loophole that wealthy investment managers use to lower their taxes in exchange for her vote on the bill. Since then, Sinema has received at least $421,000 in donations from donors in the private equity, hedge fund, and other industries that benefit from the loophole, according to a Sludge analysis of campaign finance filings.

For decades, partners and investment managers at hedge funds and other types of investment companies have managed to pay lower tax rates than many working people by treating income they earn by investing other people’s money as if it was earned through their own investing. By doing so, they are allowed to pay the capital gain tax rates of 20% or 15%, rather than the ordinary income tax rates of up to 37% for income beyond $539,900. Many Democratic members of Congress have gotten behind the idea of closing this loophole and requiring hedge fund and private equity executives to pay ordinary income tax rates on the money they earn from their investors’ assets.

A draft version of the IRA that Democratic Senators Schumer and Joe Manchin had agreed to in late July included language that would not have eliminated the loophole, but would have narrowed it somewhat. Their deal would have extended the period that investment managers have to hold their investors’ investments from three years to five years, while also making changes to how the holding period is calculated. The Manchin-Schumer agreement on carried interest would have amounted to a tax increase on investment industry managers of about $14 billion over a 10-year period, according to the senators’ one-page summary.

Sinema objected to even that relatively minor change to the loophole, forcing Schumer to give in to her demands if he wanted to advance the package in the Senate, where he could not afford to lose a single Democratic vote. “I pushed for it to be in this bill,” Schumer said about the provision he worked out with Manchin. “Senator Sinema said she would not vote for the bill, not even move to proceed unless we took it out,” he said. “So we had no choice.”

Even after getting Schumer to take out the carried interest provision, Sinema was not done working to protect the private equity industry. During the floor debate of the IRA, Sinema voted in favor of an amendment from Sen. John Thune (R-S.D.) that protects subsidiaries of private equity companies from the bill’s 15% alternative minimum tax on companies with an average income of more than $1 billion over a three-year period. Thune argued that the IRA’s minimum corporate tax would be applied to small businesses that have private equity investors because it required them to aggregate their incomes with that of other companies held by the same fund when determining if they would have to pay at least the minimum. Committee on Finance Chair Sen. Ron Wyden (D-Ore.) disagreed with Thune’s characterization, saying on the Senate floor that Thune and the senators voting for the amendment “want private equity and foreign corporations to get more favorable treatment.”

Sinema Rewarded

Since killing the carried interest provision in early August, Sinema has received a rush of donations from individuals employed by private equity, hedge fund, and venture capital firms.

Some hedge fund industry founders made their first-ever donations to Sinema after her announcement by contributing to the Sinema Leadership Fund, a new joint fundraising committee that the senator formed in September of last year: Jim Swartz of Accel Partners donated $10,800 on Aug. 22; and William Duhamel of management firm Route One Investment Company, along with his spouse, gave $21,000 on Sept. 12.

Executives with investment bank Goldman Sachs dot the roster of Sinema’s third quarter donors, including David Solomon, CEO of Goldman Sachs Group, as well as Philip Berlinksi, CEO of Goldman Sachs Bank, and Jo Natauri, a partner and global head of healthcare investing. In 2020, the firm moved to pay more of its employees with interest in its investment funds, a shift allowing them to claim lower carried interest tax rates that drew criticism from lawmakers like Sen. Sherrod Brown (D-Ohio) for exploiting the tax loophole.

In total, Sludge identified more than 120 donations to Sinema’s joint fundraising committee, or to her campaign or PAC, that were from donors in investment industries that benefit from the carried interest loophole and were given after she killed the provision on August 4.

Since July 1, over 41% of donations to the Sinema Leadership Fund have come from individuals with an interest in preserving the carried interest loophole, according to Sludge’s analysis, amounting to at least $211,000.

Many of Sinema’s recent donors are executives with investment firms that are members of a Washington D.C. lobbying group that fought changes to the carried interest rules. The American Investment Council (AIC), which says that changing the tax treatment of carried interest would discourage private investment, matched its highest lobbying spending in more than a decade last year, spending $2.5 million to lobby Congress and other federal agencies. In addition to Goldman Sachs, AIC members include private equity giant Blackstone, employer of at least a dozen donors to Sinema since August 4. Other recent donors to Sinema listed their employers as the private equity firms Cinven, Hellman & Friedman, Permira, and Tenaya Capital.

The Managed Funds Association (MFA), the hedge fund industry’s main lobbying group, leapt sharply in lobbying spending last year to a record $6.5 million as it pushed back against attempts to address the carried interest loophole. The group’s chief executive made the media rounds in August, saying that the proposed changes to how investment managers are taxed would “punish entrepreneurs in investment partnerships.” While not members of the MFA, some financiers that donated to Sinema after the August negotiations included executives with hedge funds One Tusk Investment Partners, XN LP, and Diameter Capital Partners.

The National Venture Capital Association (NVCA) also hit a new high in lobbying spending last year, at nearly $2.7 million spent, frequently touching on the issues of carried interest taxation and capital gains policy. A blog post last year on the group’s site warned that taxing carried interest at ordinary rates would pare back the number of new funds formed in emerging fields. After her stand on the carried interest rate, Sinema received a $5,000 PAC donation from NVCA. The NVCA’s members include firms where several Sinema donors since August 4 are employed, including Kleiner Perkins, Battery Ventures, Benchmark, and Shasta Ventures.

The securities and investment industry has been Sinema’s top career donor industry, according to OpenSecrets, in her runs since 2011 for the U.S. House and Senate, with more than $3.2 million given. Ahead of her deal to preserve investment managers’ preferential tax treatments, Sinema had already more than doubled her fundraising from the private equity and hedge fund industries in the 2021-22 election cycle compared with the previous two years. And more Wall Street donors showed favor to Sinema, a Senate Banking Committee member, after her demands on carried interest taxation carried the day: on August 30, Sinema reportedly visited Salt Lake City for a fundraiser hosted by lobbyists and officials with Zions Bank and the Utah Bankers Association.