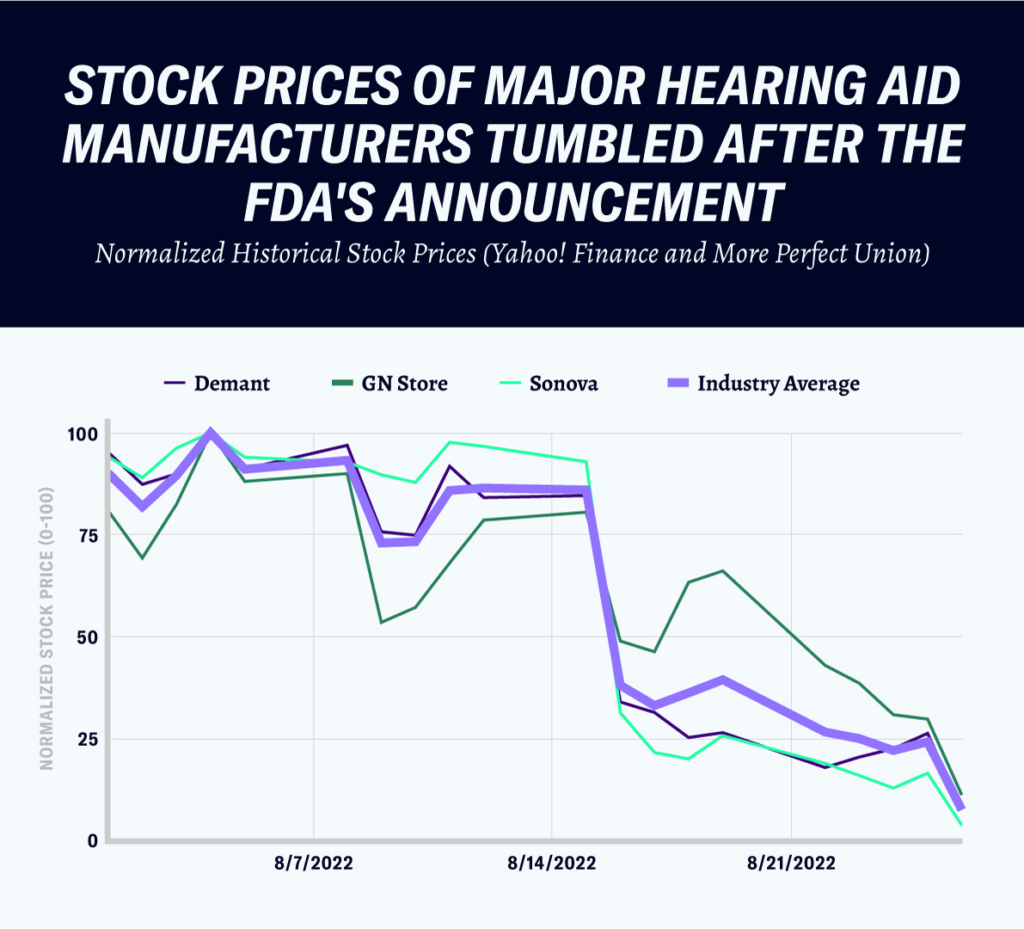

A new Biden administration rule aimed at improving the price and availability of hearing aids has upended the industry in a matter of days, with stock prices for the dominant manufacturers tumbling and major new firms announcing plans to enter the market.

Federal officials finalized an FDA rule in mid-August to increase competition in the hearing aid market, which is currently dominated by four firms that control nearly 85% of U.S. sales and generate monopoly-level margins.

The rule, which will go into effect before the end of the year, would allow people with mild to moderate hearing loss to purchase hearing aids over the counter instead of only by prescription. It stems from 2017 legislation sponsored by Senators Elizabeth Warren and Chuck Grassley that removed “outdated regulations” surrounding hearing aids.

The long-awaited decision sent stock prices for the world’s dominant hearing aid manufacturers into a nosedive. On average, stock prices for publicly traded hearing aid makers are down 18.7% since the announcement. In one instance, Sonova, which owns popular brands Phonak and Unitron, lost nearly $5 billion in market capitalization.

The dominant firms currently use their market power to act like a cartel, sometimes raising prices in tandem. “Competition, by and large, has followed suit with their price announcements,” Sonova CEO told investors shortly after the FDA announcement. “We collectively, uncoordinated as you’d expect from a compliance perspective, but one after another, increased prices.”

The new rule will potentially transfer billions of dollars from those companies to individual Americans. The Biden administration created a new category for low-level hearing loss, which is expected to open the overall market to new competition and lower prices. Last year, the Wall Street Journal reported that Apple was considering marketing a version of its popular EarPods as a health device. Industry analysts also expect Bose and Samsung to follow with several low-cost devices.

Retailers greeted the news with applause. “We are excited about the new FDA ruling,” Best Buy CEO Corie Sue Barry told investors this week. The company plans to expand their offerings and redesign over 300 stores to capitalize. It will be “more convenient than ever for the millions of Americans with mild-to-moderate hearing loss to get the products and support they need.” Walgreens and CVS announced plans to expand their in-store and offline offerings.

Hearing aids are currently expensive and often not covered by insurance

- In 2019, the average hearing aid retailed for almost $2,300.

- The major manufacturers typically bundle hearing aids with specialty audiology services (device calibration and fitting). This often results in equipment and service fees upwards of $6,000 a pair.

- The industry argues that high costs are required to ensure adequate quality, fit, and consumer safety.

The hearing aid industry earns outsized profit margins at the expense of people’s health

- The industry regularly earns a gross profit margin of 75%. That means that after production costs, for every dollar of sales, about seventy-five cents is kept by the major companies. For comparison, Apple, largely regarded as the world’s most profitable company, keeps slightly more than 40 cents for every dollar it sells. Exxon, which has recently come under fire for price gouging, brings in 32 cents.

- The National Institute on Deafness and Other Communication Disorders estimates that almost 30 million American adults could benefit from hearing aids, but only 16% have used them.

The hearing aid industry fought the changes with lobbying and an astroturfing campaign

- In 2022, Starkey, the lone major U.S.-based hearing aid manufacturer, spent over $800,000 on campaign contributions–an increase of almost 500% since 2016. This year the industry spent about $1.2 million on lobbying efforts.

- The FDA received approximately 1,100 public comments on the regulation. According to an analysis by the bill’s sponsors, one in four comments replicated “industry-driven talking points” while following one of three templates.

- The industry sought to lessen the effectiveness of OTC hearing aids by restricting their overall effectiveness.

The decision is another test-case in the Biden Administration’s economic world view. The Administration has pinpointed concentrated markets as a cause of rising inflation. In addition to hearing aids, meat processors, drug companies and airlines have all been used as examples of areas where a lack of competition leads to higher prices. “They are really trying to think about these industries where Americans do have those everyday costs and asking the question, whether concentration and competition issues are key factors in the prices that Americans see.” Amara Omeokwe, a reporter for the Wall Street Journal, said on a podcast earlier this month.